Make e-invoicing simpler. Maintain complete ZATCA compliance.

Make e-invoicing simple while staying fully compliant with the Saudi Zakat, Tax and Customs Authority in KSA (ZATCA). Phase 2 of ZATCA e-Invoicing (FATOORA) requires businesses to connect their ERP, POS, or accounting software directly to the FATOORA platform, ensuring invoices are created, stamped, validated, and reported in real-time.

Ledgerwise delivers professional ZATCA FATOORA integration services, seamlessly connecting your ERP, POS, or accounting software with the official portal. We ensure your existing systems fully comply with ZATCA e-invoicing regulations, without requiring major changes or disruptions to your operations.

Our expert team manages the entire process — from XML formatting and cryptographic stamping to QR code embedding and secure reporting — so you can focus on running your business.

With Ledgerwise, your invoices stay 100% compliant with the Zakat, Tax and Customs Authority, keeping your business efficient, risk-free, and future-ready

Our Services Include:

Evaluate your current systems and map ZATCA requirements.

Connect your ERP, POS, or accounting software to FATOORA.

Ensure all invoices pass ZATCA test cases.

Deploy the system and monitor compliance in real-time.

Keep your invoicing system updated with evolving ZATCA e invoicing in KSA regulations.

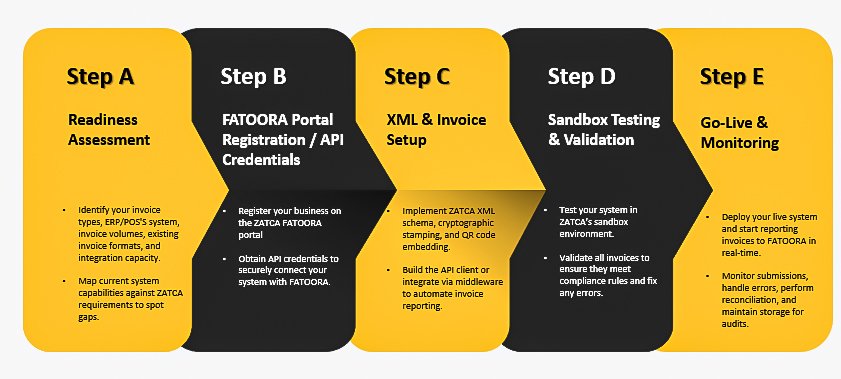

Registration & Compliance Steps

Ledgerwise guides your business step-by-step to ensure full ZATCA compliance:

Whether you use ERP solutions like SAP or Oracle, POS systems like Foodics, or accounting tools like QuickBooks, Ledgerwise delivers secure, automated, and compliant integration tailored to your business needs.